stock sell off meaning

As more shares are offered than buyers are willing to accept the decline in price may accelerate as market psychology turns pessimistic. It is the accelerated selling of securities including stocks bonds commodities and currencies.

Sale Vs Sell What S The Difference Dictionary Com

Most financial advisors do not suggest letting taxes determine your investing.

. Sell something off meaning. They are often caused by a mass panic in reaction to an event that prompts several. The most recent sell-off in stocks is.

If both lines are moving higher and they stay in green. Upon the market reaching and trading at. Noun a usually sudden sharp decline in security prices accompanied by increased volume of trading.

The end of the quarter refers to the conclusion of one of four specific three-month periods on the financial calendar. When a substantial number of shareholders sell a specific stock it is called a sell-off. According to the IRS the majority of investors enjoy a long term capital gains tax rate of just 15.

Ideally you can do this at any point and dont have to wait for a correction but a. An act or instance of liquidating assets or subsidiaries as by divestiture. A sell-off typically triggers a negative shift in market sentiment that.

The four quarters end in March or Q1. The stock market sell-off is almost over and resilient earnings and slowing inflation means a rally is on the way JPMorgan says. A sell stop order triggers an execution once the stock reaches a certain price below the prevailing market known as the stop price.

A sudden and marked decline in stock or bond prices resulting from widespread selling. The technical definition of a market crash is that stocks fall by 10 percent or more in one day. To charge a low price for something to encourage people to buy it.

To sell all or part of a. While orange line represents relative strength vs. The sell-off definition refers to a period of time when selling activity prevails over buying pushing the price of an asset down.

A sell-off occurs when a large volume of securitiesare sold in a short period of time causing the price of a security to fall in rapid succession. There are several potential triggers of a s See more. A sell-off however is different.

This is the nature of the market. Generally speaking prospective buyers sit on the sidelines until the conditions that caused. Stock market sell-offs are also a solid reminder for investors to reassess their holdings.

Purple line represents trend strength of underlying symbol.

Market Correction What Does It Mean Charles Schwab

Sale Vs Sell What S The Difference The Grammar Guide

Stock Market Sell Off Explained Benefits For Day Traders

Selloff Overview How It Works Sovereign Selloffs

3 Ways To Turn Your Lease Into Cash Edmunds

Sell Off Definition And Meaning Capital Com

Standard Deviation Indicator Fidelity

Difference Between Intraday And Delivery Trading Kotak Securities

Stages In A Bubble The Geography Of Transport Systems

Goto Shrugs Off Tech Rout To Seek 29bn Valuation

Sell Off Definition Forexpedia By Babypips Com

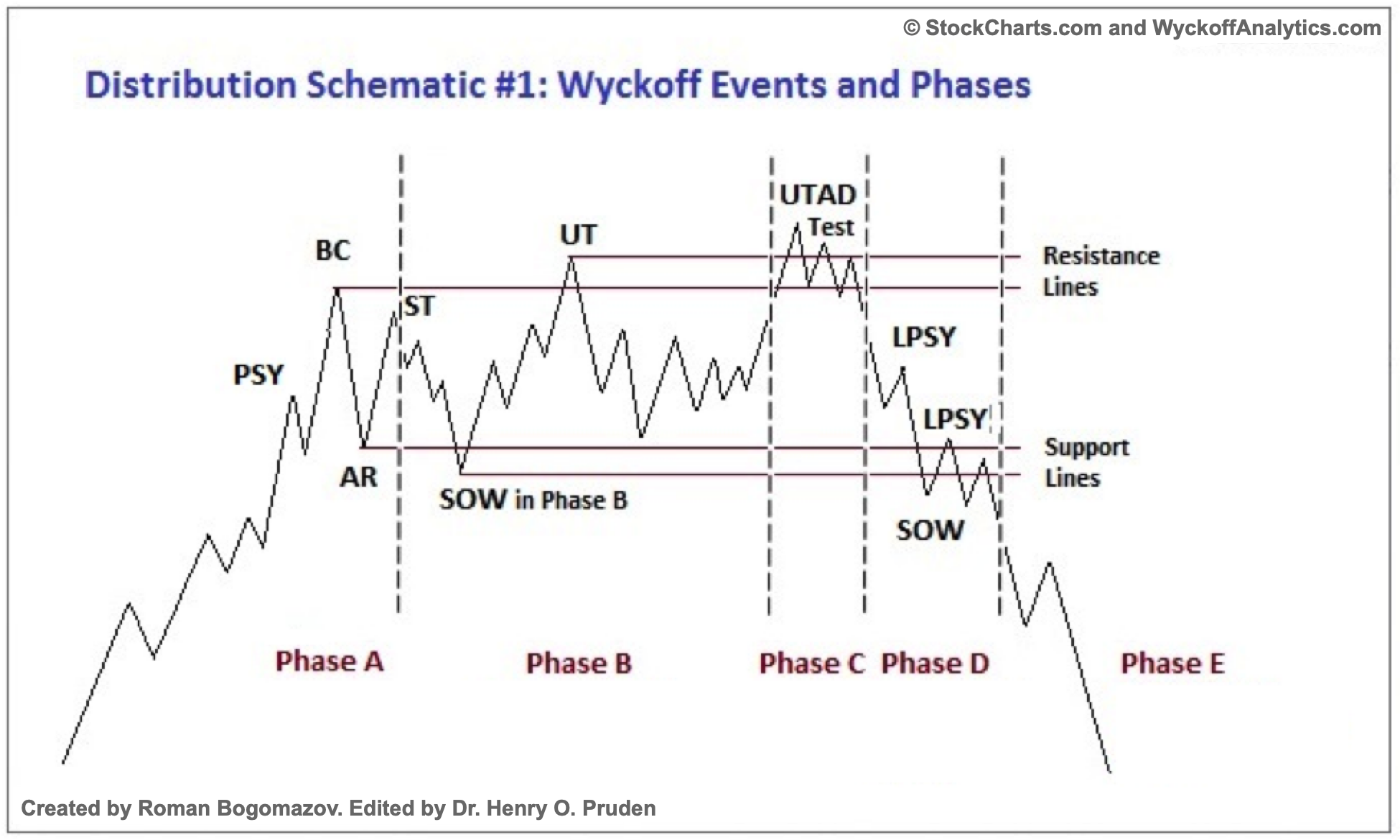

The Wyckoff Method A Tutorial Chartschool

Pmi Precious Metals International Ltd Bullionpmi Definition Selloff Securities Stocks Bonds Etfs Earningsreport Facebook

Divestiture M A Strategy And Corporate Action

:max_bytes(150000):strip_icc()/dotdash-TheBalance-what-are-stocks-3306181-Final-75b1bb359b7141d9a22cb1b706f2cf2f.jpg)

/shutterstock_635544212-5bfc324546e0fb00260c5feb.jpg)